Welcome to the ninth issue of Emerging Tech Law.

In this issue:

- Identity of blockchain/Bitcoin inventor remains a mystery after Florida court case.

- Implications of Instagram hearing: expect no legislation but tougher road for Meta in building out the metaverse.

- Senate confirms first woman to lead FCC. Expect new fight over net neutrality rules.

Quote of the week:

“Every informed person needs to know about Bitcoin because it might be one of the world’s most important developments.”

—Leon Luow, Nobel Peace Prize nominee

BLOCKCHAIN

Florida court decides case involving origins of Bitcoin

Blockchain technology, which underlies Bitcoin and other crypto currency, has the potential to revolutionize the financial industry, supply chains and even the primary model for online businesses. But its origins have been shrouded in mystery.

A Florida jury recently decided a case involving the early days of Bitcoin and blockchain technology, but the identity of its inventor remains a mystery.

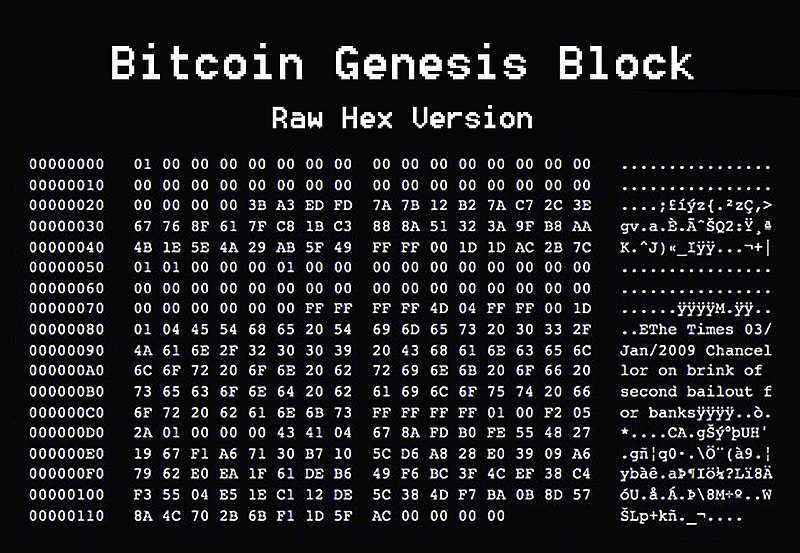

If you know a little about the history of blockchain and Bitcoin, you know that it started with the release of a white paper in 2008 under the name Satoshi Nakamoto, a presumed pseudonym for a computer programmer (or group of programmers) with a deep understanding of cryptography. Shortly after the white paper was issued, the code for Bitcoin was released and the first block of the Bitcoin blockchain – the Genesis block – was mined.

Nakamoto remained active for a few years working on the Bitcoin code, but posted a final message to the Bitcoin community forum almost exactly eleven years ago on December 12, 2010. At the time, Bitcoin was trading for twenty cents. It now trades for about $50,000, and some believe Nakamoto has control of as many as 1.1 million Bitcoins, making Nakamoto worth about $50 billion and one of the richest people in the world.

Not shockingly, numerous people have claimed to be Nakamoto, including an Australian computer scientist named Craig Wright.

Wright worked with another computer programmer named Dave Kleiman in the early days of Bitcoin. Kleiman, who had earlier been paralyzed from injuries he suffered in a motorcycle accident, died in 2013 apparently of complications from an infection.

Kleiman’s brother Ira filed a lawsuit in 2018 against Wright, claiming that his brother and Wright were legally partners acting together under the Satoshi Nakamoto pseudonym to develop Bitcoin. The suit claimed the Kleiman estate was entitled to half of the value of the Bitcoin allegedly controlled by Nakamoto, approximately $25 billion.

The lawsuit has brought out some fascinating details regarding the early days of blockchain and Bitcoin.

After Kleiman died, Wright wrote Kleiman’s father the following email:

“Hello Louis,

Your son Dave and I are two of the three key people behind Bitcoin . . .

If you have any of Dave’s computer systems, you need to save a file named “wallet.dat”. I will explain what this is later. Please understand, I do not seek anything other than to give you information about your son.

Know also that Dave was a key part of an invention that will revolutionise the world . . .

I will talk to you again soon.

When I can, I will let you know much more of Dave. I will also help you recover what Dave owned.

I will let you know when I am in the USA.”

Don’t Lose the Wallet.dat File

The wallet.dat file may have held the private keys needed to access Bitcoin accounts. The Florida court noted that Ira Kleiman, after deciding that some hard drives owned by his brother were empty, reformatted the drives and saved other files to them. This may have wiped away the private keys to an enormous fortune. The Nakamoto accounts have not been touched in years.

Because Kleiman’s father, Louis, was elderly, his brother, Ira, took over communications with Wright, and things took a more sinister turn.

Ira Kleiman sent an email to Wright a few months after Wright’s email to Kleiman’s father about business documents Ira had received from the Australian Tax Authority that was looking into tax implications of Bitcoin. Ira Kleiman’s email to Wright alleged “questionable discrepancies in the contracts … such as Dave’s signatures, his resignation, transfer of all accountable value … etc. No need to go into details.”

In a decision on a motion in the Florida case, the court noted Wright’s admission’s about Kleiman’s involvement in Bitcoin.

“Dave was a key part of everything that I did. Dave spoke as Satoshi,” and he and Mr. Kleiman are Satoshi Nakamoto,” were among Wright’s claims according to court documents. “Likewise, when asked who created the pseudonym Satoshi, he stated “[m]ostly myself, and a little bit with Dave. Both of us acted. Dave was the nice version of Satoshi.” … “I had an idea, but it would never have executed without Dave[.] Dave was my sounding board, he fixed my errors.”

The jury in the case found Wright liable of conversion of intellectual property and awarded a judgment of $100 million to a joint venture between Wright and Kleiman. But the jury found insufficient evidence to establish that there was a legal partnership between Kleiman and Wright that would have entitled Kleiman’s estate to any Bitcoins held in accounts controlled by Nakamoto.

Contrary to claims in some news reports and Wright’s statement after the trial that the jury had found that he was the creator of Bitcoin, the jury made no such decision. It’s also significant that the judge in the case noted that Wright had provided forged documents and given perjured testimony.

If the jury had found that there was a partnership between Wright and Kleiman, it would have forced Wright to access the Nakamoto accounts in order to pay the judgment, consequently confirming whether Wright was indeed one of the Bitcoin founders. But for now, it remains a mystery. It remains possible, however, that if Wright is unable to otherwise pay the $100 million, he could be subject to a court order that would force him to access the Nakamoto accounts if he is able to.

For a deeper dive: The court’s decision on the motion for summary judgment is rich with details. Kleiman v. Wright, Case No. 18-cv-80176-BLOOM/Reinhart, 56 (S.D. Fla. Sep. 18, 2020)

Instagram, Web 3.0 and the Metaverse

A Senate committee made headlines this past week as committee members grilled the head of Instagram about the social media platform’s impact on kids. The attention on Instagram, however, has implications beyond the focus of the committee.

The hearing of the Senate Subcommittee on Consumer Protection, Product Safety, and Data Security focused on concerns “about the product designs and powerful algorithms that push content to kids and create addiction-like behaviors.” The hearing drew further attention to internal company documents that showed Instagram has a negative impact on body image issues for a substantial percentage of teen girls.

Although Instagram head Adam Mosseri told the committee that he was proud of the work his company had done in protecting teens, committee members castigated Mosseri and the company.

The criticism was bipartisan. Republican Marsha Blackburn told Mosseri that parents “continue to hear from you that change is coming, that things are going to be different…. Guess what? Nothing changes. Nothing.” Democrat Amy Klobuchar said, “Our kids aren’t cash cows. When you look at what your company has done, it’s to try and get more and more of them on board.”

Although the hearing focused on Instagram and kids’ safety and mental health, there are the broader implications, as Instagram’s parent company Meta (formerly Facebook) seeks to be a leader in the development of the virtual world known as the metaverse, which some believe will be the next iteration of the Web.

Quick Takes

Here are a few takeaways:

1. Building the Metaverse through acquisition: Instagram was a key acquisition for Facebook that not only helped the company’s appeal with younger users, but as Klobuchar has said the acquisition helped Facebook avoid competition. The acquisition was subject to regulatory approval, but many view the approval of the acquisition as a mistake. As Meta aims to build out the metaverse, the negative attention that has been heaped on the Instagram acquisition will make it unlikely that Meta can do so through significant acquisitions of other businesses.

Meta may still be able to be a formidable force in the metaverse, but it will have to focus on building any missing pieces organically. Other competitors may not be subject to the same obstacle and may be able to acquire missing pieces through M&A deals. It’s worth noting that another second order effect, though, may be that there is less incentive for startups to enter the metaverse space. Acquisitions are one of the primary exits for startups, and taking one of the biggest players in the space out of the equation could mean fewer new entrants.

2. Federal law: Don’t expect the Instagram hearing to be the catalyst for a new federal law. After every one of these hearings in which Big Tech execs are trotted out to account for their perceived misdeeds, there is renewed discussion of the need for further regulation of tech companies. And every time, that renewed hype fizzles.

It will be the same this time. This is the case for a variety of reasons: Democrats are friends of Big Tech. Republicans hate regulation. It’s challenging to regulate online content without infringing on First Amendment rights. Earlier efforts to regulate treatment of kids online were subject to litigation and were largely ineffective.

3. New business models: The issues identified in the Instagram hearing could be solved to some degree by new business models. Big Tech (with Apple being an exception to some degree) relies on a business model in which users give up data in exchange for services. The model has been effective. We get really good search, connect with friends and family and are able to consume enormous amounts of content, all for free.

The downside is that we give up enormous amounts of information in exchange, and that information is used to fine-tune the algorithms that deliver content to us. (This is great when it means you get content you want; not great when it means, for example, that teen girls are bombarded with content that worsens body image issues.)

As the market cap of Alphabet (Google’s parent company), Meta, Microsoft, Apple and Amazon exceed $1 trillion, it’s time to wonder if the exchange is fair. Blockchain technology, which enables cryptocurrencies, also provides a means for controlling data and the enablement of micropayments. One of the leaders in this area is Brave Software, which offers the Brave browser. Users of the Brave browser have extensive control over the sharing of their data and are awarded crypto tokens for their time and attention. As Brave proves out its business model, others may follow.

TELECOM

The U.S. Senate confirmed acting FCC Chair Jessica Rosenworcel to a new 5-year term, making her the first woman to serve as the appointed head of the Commission.

The confirmation means Rosenworcel will lead the FCC at a critical time for the tech industry, as the Commission will oversee billions of dollars in funding for improving broadband connectivity and may revisit the politically charged topic of net neutrality.

Senate Majority Leader Chuck Schumer said in a Tweet, “she’s set herself apart as one of America’s leading champions for a more affordable and accessible high-speed internet. Under her leadership, the FCC will make immense progress to address the digital divide.”

With Rosenworcel as its head, the FCC will oversee over $60 billion in funding from the recently enacted infrastructure law to expand broadband connectivity.

Rosenworcel also supports reinstatement of net neutrality rules that prohibit Internet Service Providers from discriminating against certain traffic on their networks.

When the FCC decided in 2017 to repeal the net neutrality rules, Rosenworcel said,

“The future of the internet is the future of everything. That is because there is nothing in our commercial, social, and civic lives that has been untouched by its influence or unmoved by its power. And here in the United States our internet economy is the envy of the world. This is because it rests on a foundation of openness. That openness is revolutionary. It means you can go where you want and do what you want online without your broadband provider getting in the way or making choices for you. It means every one of us can create without permission, build community beyond geography, organize without physical constraints, consume content we want when and where we want it, and share ideas not just around the corner but across the globe. I believe it is essential that we sustain this foundation of openness—and that is why I support net neutrality

Some commentators allege that the Internet apocalypse that was predicted when net neutrality was repealed has not occurred, but Gigi Sohn, whose nomination to serve on the FCC, along with Rosenworcel, still is under consideration by the Senate claimed in a 2019 interview that the impact of the repeal has been “death by a thousand cuts but the cuts are deeper than people think.”

Sohn said the effect went beyond just net neutrality issues because the repeal of the rules means the FCC has abdicated oversight over broadband connectivity. Sohn cited as consequences of this abdication the lack of agency action in response to Verizon’s throttling of a California fire department’s broadband connection during a large forest fire, T-Mobile, Sprint and AT&T’s sale of customers’ precise location data and Frontier’s charging a customer for rent on a router when the customer had bought his own router.

Although Rosenworcel’s confirmation received bi-partisan support, Sohn’s nomination may be blocked by Republicans leaving the FCC split with two Republican-appointed commissioners and two Democratic-appointed commissioners. As long as the Commission remains evenly divided, action on net neutrality is unlikely.

ALSO NOTEWORTHY

- A couple that met as avatars at a virtual conference six years ago took their wedding vows recently in a virtual ceremony in the metaverse. So far, a virtual wedding ceremony doesn’t have legal effect, so the couple also had a IRL ceremony at a country club in New Hampshire. After news articles claimed the wedding was a first, others noted that virtual weddings have been taking place for years on platforms such as Second Life.

- Pulp Fiction Director Quentin Tarantino is fighting back against a lawsuit by studio Miramax that aims to block him from selling nonfungible tokens (NFTs) based on his handwritten screenplay for the movie. Miramax claimed in a federal lawsuit that Tarantino did not have the right to sell the NFTs. Tarantino’s lawyers claimed in a response that “As Miramax knows well, Tarantino has every right to publish portions of his original handwritten screenplay for Pulp Fiction, a personal creative treasure that he has kept private for decades.”

- Apple won a reprieve from having to make changes to its App Store rules in response to a court order in an antitrust case filed by Fortnite creator Epic Games. The 9th Circuit Court of Appeals issued a stay, allowing Apple to avoid making changes to its App Store rules while it pursues an appeal of the lower court’s ruling. The lower court would have required Apple to allow developers to allow links in buttons to outside payment systems rather than requiring developers to use Apple’s own in-app payment system for which Apple charges a commission on sales.

“There is a vitality, a life force, an energy, a quickening that is translated through you into action, and because there is only one of you in all time, this expression is unique. And if you block it, it will never exist through any other medium and will be lost.”

~Martha Graham, modern dancer and choreographer

Obligatory disclaimer: Any opinions are those of the cited source or the author of this newsletter, not the author’s employer. If for some reason you think any legal advice is given in this newsletter, you’re sadly mistaken.